DCF of Shopify (SHOP) 2025

Let’s give this a try for calculating the Discount Count Flow of Shopify (SHOP). I’m going to use the USD ticker compared to the Canadian one. I also do not think that this isn’t accruate valuation. Shopify is investing heavily in growth right now. Using historic numbers isn’t the best way to value this stock. It’s better to answer the question what happens when they kill Salesforce Commerce Cloud, Magento, a chunk of WooCommerce and most internal teams. But this is a learning exercise.

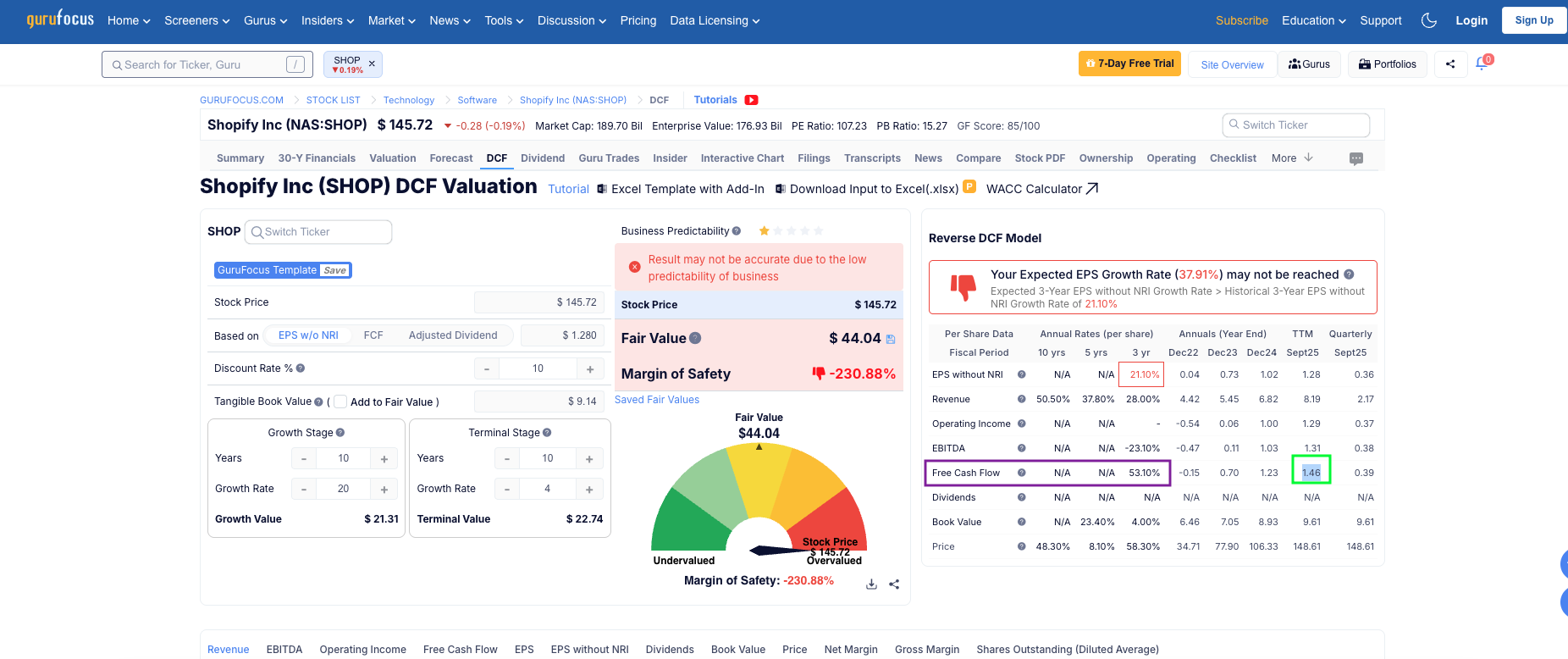

First pulling the Free Cash Flow from Guru Focus.

You can see the $1.46 in the green box.

I’m going to use a 20% growth rate which is entirely a magical number.

| Current | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Free Cash Flow | 1.46 | 1.75 | 2.10 | 2.52 | 3.02 | 3.63 | 4.35 | 5.23 | 6.27 | 7.53 | 9.03 |

Then the terminal value is 9.03 x 20. I’ve been trying to understand where 20 comes from “Cash Flow Multiple” which I’m being told is “standard”. This means a sell price of $180.60. The current price is $145.98.

I’m going to apply a discount rate of 10% (again slightly made up number).

| Current | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Free Cash Flow | 1.46 | 1.75 | 2.10 | 2.52 | 3.02 | 3.63 | 4.35 | 5.23 | 6.27 | 7.53 | 9.03 |

| Present Value of Free Cash Flow | N/A | 1.59 | 1.73 | 1.89 | 2.06 | 2.25 | 2.46 | 2.68 | 2.92 | 3.19 | 3.48 |

This formula for present value (PV) of Free Cash Flow (FCF) is:

= Free Cash Flow / 1 + discount rate (/100)

For example:

= 1.75 / 1 + 0.10 = 1.59

Then for each following year,

= 2.10 / 1 + 0.10 <-- This is wrong

^ You need to discount by 2 years, so (1.10) ^ 2.

= (1.10) ^ 2 = 1.21

And for year 2 it is:

= 2.10 / 1.21 = 1.73

Then the sum is 24.30.

Finally, the present value of our terminal value is:

(1.10)^10 = 2.5937

PV(TV) = 180.60 / 2.5937 = 69.72

The 180.60 comes from above.

The Intrinsic value is:

= 24.30 + 69.72 = 94.02

Now that we have an intrinsic value of $94.02 for Shopify (SHOP), we can calculate the Margin of Safety (MoS), which tells us how much the current market price is below (or above) the fair value.

This Formula from GuruFocus uses is:

# Margin of Safety (%) formula

Margin_of_Safety = (Intrinsic_Value - Market_Price) / Intrinsic_Value * 100

For Shopify:

- Intrinsic Value (from DCF): $94.02

- Current Price: $145.98

= ((94.02 - 145.98) / 94.02) x 100 = -55.3%

Since the Margin of Safety is negative, the stock is currently trading above the calculated fair value.

The screenshot at the top of the GuruFocus page has a Margin of Safety at -231% (uses EPS w/o NPS). Plus the difference here is the growth rate used (20%), and the multiple of cash flow number (x 20).